Multifamily real estate is poised to continue its gains realized over the past couple years, according to a panel of experts at a Reonomy webinar on Feb. 23. Facilitated by Richard Kalvoda, senior executive vice president of Altus Group, the panel included Bryan Doyle, managing director at CBRE Capital Markets, Timothy Savage, professor at NYU’s Schack Institute of Real Estate, and Brian Bailey, subject matter expert in CRE from the Federal Reserve Bank of Atlanta.

While the overall session focused largely on the overarching economy and many macroeconomic factors, from interest rates to inflation, several key discussions highlighted the performance — and outlook — for the U.S. multifamily sector.

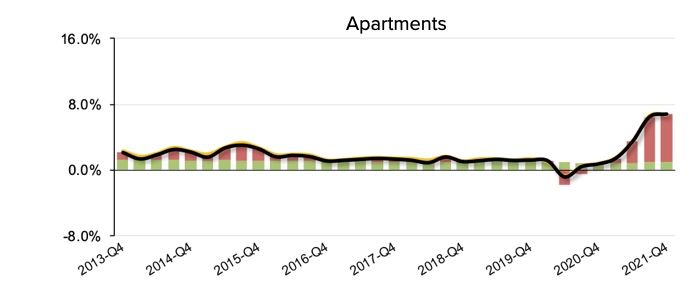

Multifamily assets realized returns of 6.8% in the fourth quarter last year alone, outperforming most other sectors. Annualized returns over a two-year period, essentially covering from the start of the pandemic, hit 10%. While the high-growth industrial sector punched even higher — at a staggering 26.7%, according to data compiled by Altus Group — apartment investments have some advantages over industrial.

Apartments as an Inflation Hedge

This could be especially true in terms of inflation. New York University’s Savage said on the call that, “The shorter duration the lease, the better the inflation hedge.” With traditional apartment leases running for typically 12 months — compared to several years or more in most other commercial asset classes — investors are freer to adjust pricing to ensure rental income outpaces rising costs.

At the same time, though, don’t expect multifamily rents to continue growth at the same pace as in the past year, according to Northmarq’s 2022 outlook. Supply issues remain, and occupancy is largely expected to remain at all-time highs, but multifamily investors need to refocus on driving NOI growth, particularly as interest rates seem very likely to increase this year, Savage noted.

While large, institutional investors may have a wealth of proprietary data to tap into to drive NOI growth, smaller multifamily owners should also use available strong data at their disposal. As Savage put it, “We had the luxury in a declining market to sit on assets.”

Cap Rate Changes

Acknowledging the likelihood of a number of interest rate increases this year, both Doyle and Bailey highlighted the unknowns regarding how this could impact cap rates, both within and outside the multifamily sector. Savage commented that, “There will be upward pressure on cap rates from monetary tightening.” The professor also mentioned that, as the Fed’s asset buying has significantly decreased, this too could generate additional increases to cap rates across the board.

That said, multifamily could feel the effects in divergent ways. Owing to the so-called “flight to quality,” some well-placed luxury assets may fare well, while Class B assets in certain markets — too expensive for many renters, and not as desirable for many others — may see challenges in the near and long term.